Financing & Warranties

Your Hometown Roofing Services Provider

Advance Seamless Guttering and Roofing offers payment plans through local Banks, Credit Unions and Third Party Lenders to help make roof replacement costs more affordable.

Payment plans vary according to requirements, interest rates and terms, so it’s important to ask Us about what you have in mind …For more details call.

24/7 Emergency Roofing Service.

423-506-8290

ROOF FINANCING

Whether your new roof is the result of a planned project or because of unexpected circumstances, it can represent a significant, but necessary, home investment. After all, a roof helps to keep your home and family protected from the elements.

Finance Your Next Roofing Project

The cost of a new roof varies widely because it depends on several factors, including:

- The size and complexity of the roof

- The type of roof shingles used

- The roofing contractor hired to do the job, as labor rates vary among pros

- Your geographical area

These variables can make it difficult to save for a roofing project accurately, and that’s where roof financing can help.

Roof Financing Explained

Before diving into the reasons homeowners choose to finance their roofing project, let’s cover a few basic words often thrown around by lenders:

- Term refers to the length of time you have to repay the loan. It’s usually expressed in months or years.

- APR (annual percentage rate) determines how much the lending company is charging you for the loan of the money. It may or may not include fees, and it doesn’t include the compounding effect of interest — most interest compounds monthly. APR is a useful tool for comparing loan products.

- Principal represents the total amount of money borrowed at the onset of the loan.

- Interest is the cost of your loan over and above the principal amount.

Why Roof Financing Can Be a Good Idea

It’s easy to forget about your roof, and homeowners often put off repairing or replacing an aging roof until serious warning signs appear. Other times, Mother Nature may wreak havoc with your shingles or send a wayward tree branch that causes damage.

If you’ve built up a fund for roof maintenance and repair, that’s great, but many times we’re left unprepared when roof needs come calling. Even if the damage is covered by your insurance, you may be left with a hefty deductible that’s not in your budget. Or, you may decide it’s time to replace the entire roof with new and improved materials rather than do a repair.

We as a independent roofing contractors offer financing options for customers.

Here are some reasons to consider roofing financing for your roof repair or roof replacement project.

Enjoy Low Monthly Payments

When you finance a new roof through an independent roofing contractor, you can benefit from low monthly payments. This lets you pay for your roof in installment amounts you can afford and prevents you from having to pay for a multi-thousand-dollar roof project in one lump sum.

Depending on your payment terms and credit history, you may also be able to benefit from low-interest rates during the life of the loan.

For example, an unsecured home improvement loan of $10,000 for 120 months results in a low monthly payment of $132 with a 9.99% APR*.

Defer an Upfront Payment Without Interest

Homeowners looking to delay a lump sum payment while still avoiding interest should consider loans with 0% financing up-front with no prepayment penalties.

Installment loans that offer six months of no interest and no payments let you defer making any payments at all during the first part of the loan.

You can pay the entire loan off (interest-free) any time before the six-month deadline or begin making the required monthly payments at the updated interest rate.

Delay Payments

Some loans let you put off making payments for a set period. Once the time is up, you’ll begin making regular payments at the fixed interest rate. This is especially helpful for situations where you’re short on cash but need to get started on the roofing project without delay for safety concerns or other reasons.

Quick Approval Process

Applying for roof financing can be an easy, seamless process thanks to modern technology. You can apply for roof financing online, via a mobile app, or call in, completely eliminating paperwork. You will need to provide an electronic signature. Once you submit your information, approval notices usually arrive within minutes.

Roof Financing During COVID-19

Due to the potential financial impacts from COVID-19, it’s more important than ever to have options when it comes to being able to afford an important home expense like a new roof.

Roof financing lets you protect your investment and keep your family safe without having to worry about making large, lump-sum payments.

An Investment with Attractive Returns

According to a 2019 Remodeling Impact Report from the National Association of the Remodeling Industry (NARI), the impact of installing a new roof can be significant — homeowners may be able to recover 107% of the cost after installation when they go to sell their home.

In this same report, it was found that new roofing ranked high on home buyers’ lists, which means that if you’re thinking of selling your home in the future, a new roof might help you do it faster and fetch a larger price.

When you choose roofing financing, you get the best of both worlds — you can invest in your home for the future, address existing roof problems and get the roof of your dreams at a price you can afford.

Find out more information about roof financing from Advance Seamless Guttering and Roofing.

FAQs

How long can you finance a roof for?

Loan terms are going to vary by lender. Shorter loan terms mean you pay off the debt sooner, and likely pay less interest, but longer loan terms ensure your monthly payment is lower and more affordable.

While you might pay slightly more interest over the long run, many homeowners choose a 120-month term or longer to ensure payments remain within their budget.

Do roofers offer payment plans?

Yes. Advance Seamless Guttering and Roofing offers payment plans through local Banks, Credit Unions and Third Party Lenders to help make roof replacement costs more affordable.

Payment plans vary according to requirements, interest rates and terms, so it’s important to ask Us about what you have in mind for more details.

Can my insurance pay for a new roof?

It depends on your policy and the circumstances surrounding why you need a new roof. If it’s because of a weather-related event, then homeowner’s insurance coverage might apply. But if you’re just looking to replace it because of age or to up its resale value, homeowner’s insurance likely wouldn’t assist with the cost.

Warranties

Roofing Material Warranty

This is one of the most common roofing warranties you’ll find available to homeowners. With a shingle roofing material warranty, it offers protection in the event that the shingles are defective. This warranty is offered in the ballpark timespan of 25 years and sometimes more.

The roofing material warranty is important to include with a new roof, but it’s not necessarily enough to fill the gaps on coverage of all roofing materials. Keep in mind that your roof is engineered as a system and includes many working parts other than the shingles.

Furthermore, even if you have coverage with a roofing material warranty, it may only cover the cost of the parts for the new materials. This leaves the homeowner footing the bill for roofing installation, which can also be costly.

Roofing Workmanship Warranty

Workmanship and installation is a major component of new roofing. Without sufficient and guaranteed professional installation, even the best roofing can fail to perform.

This is why homeowners need to choose a roofing company that offers both a material and workmanship warranty.

What Does a Roofing Workmanship Warranty Cover?

This warranty offers protection for labor and installation. It’s essentially a warranty that offers peace of mind knowing that the roofing contractor stands by their work, guaranteeing performance for years to come.

Lifetime Coverage on a Roofing Warranty

Lifetime is a sticky term for a roofing warranty. It’s a common misconception that lifetime literally means for life. Many times this is not the case. Some roofing companies define lifetime as a mere 5 years. With the average lifespan of an asphalt roof coming in around 25 years, it’s important to select a warranty that offers ample coverage through its lifetime.

Lifetime may vary between manufacturers due to climate and roofing material. Climates that experience extreme temperature variations throughout a single day may have lesser lifetime warranty coverage, such as areas with desert conditions. Generally, asphalt shingles are very durable to many types of climates and offer substantial coverage and protection for the home.

Roofing Workmanship Warranty

The workmanship warranty is one of the most important aspects of a roofing warranty. This is protection against installation errors. The length of the workmanship warranty depends on the warranty you choose, and may not be covered at all.

It is highly recommended that when considering replacement roofing companies you choose one that offers a workmanship warranty.

What is the Best Roofing Warranty?

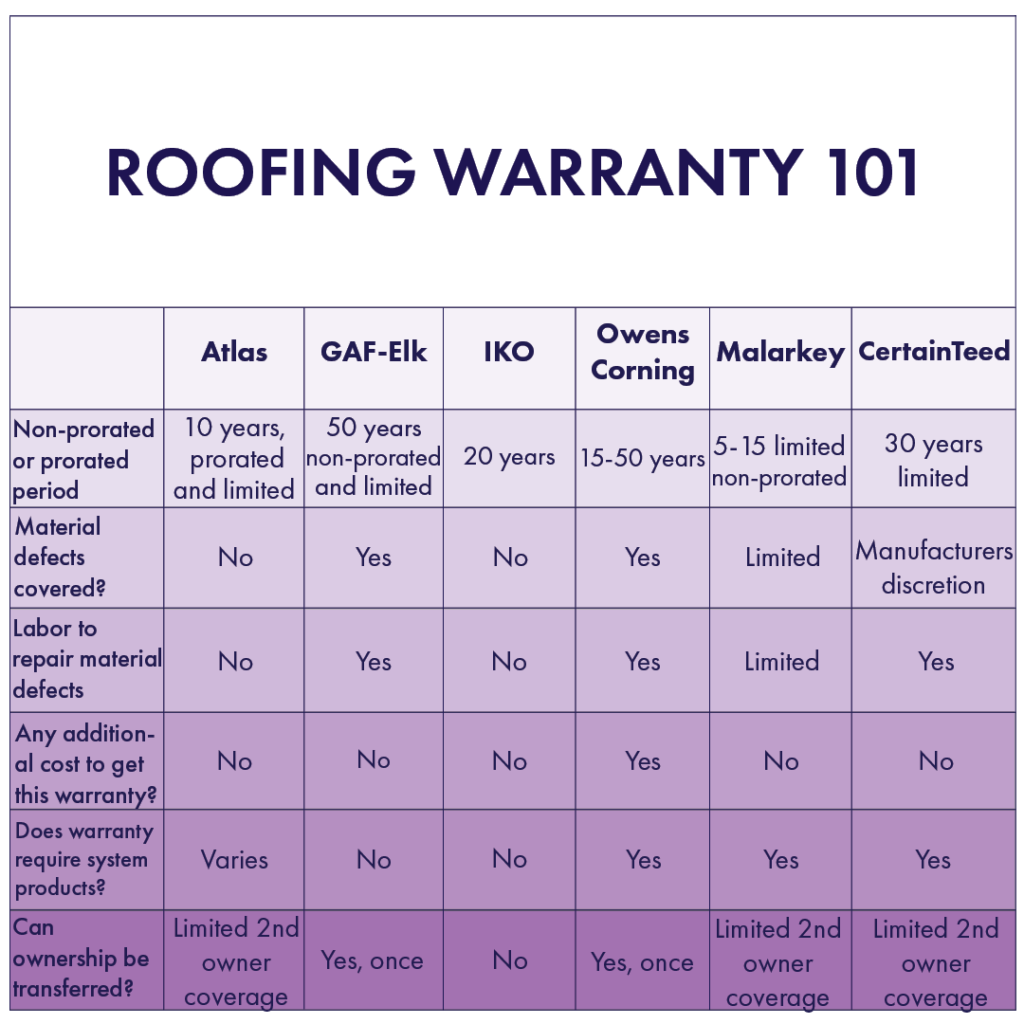

While the different coverage aspects of a roofing warranty are going to be more advantageous to different homeowners depending on their specific needs and circumstances, the best roofing warranties offer 10 or more years of coverage on workmanship, non-prorated periods of 25 years or more on materials, 20% or more prorated periods on materials, and are transferrable to subsequent homeowners.

Every roofing company’s level of coverage is different depending on their roofing manufacturer and the level of service they’re willing to provide to their customers throughout the life of their roof.

Need A Free Estimate?

When you need a Roofing Specialist to examine the condition of your roof, check for problems or predict how much longer the roof can last before you need a new one, then call us now.